Taking the plunge into homeownership or a major 35 loan purchase often involves securing a loan. With so many loan options available, it can be overwhelming to determine the best fit for your unique needs. Upon making a decision, it's vital to meticulously evaluate your financial situation and goals. Comprehending the various loan types, their features, and potential consequences will empower you to make an savvy choice.

- First

- Let's the popular loan options available.

Exploring 35 Loans: A Comprehensive Guide for Borrowers

Embarking on the journey of obtaining a loan can be daunting, especially when faced with numerous choices. A 35 loan, a specialized type of financing, presents itself as a feasible solution for individuals seeking to fund specific goals. This thorough guide aims to uncover the intricacies of 35 loans, providing you with the knowledge necessary to make informed choices.

- Firstly, we will delve into the mechanics of a 35 loan, explaining its framework and key attributes.

- Next, we will explore the eligibility for obtaining a 35 loan, outlining the considerations that lenders typically assess.

- Moreover, we will discuss the benefits and limitations of 35 loans, enabling you to assess whether it aligns with your monetary situation.

- In conclusion, we will provide useful recommendations on how to apply for a 35 loan, streamlining the application and increasing your chances of approval.

Acquiring Your 35 Loan: A Step-by-Step Guide|Applying for a 35 Loan: Navigating the Process|Understanding the 35 Loan Application Process}

Embarking on the journey of acquiring a 35 loan can feel challenging, but with a clear knowledge of the process, you can smoothly traverse it with confidence. This comprehensive guide will clarify each stage, providing valuable insights to help you prosper in your application. First and foremost, collect all the necessary documents, including your identification, financial statements. Next, carefully fill out the loan request correctly, providing complete information about your financial history. Remember to review your application before presenting it to avoid any errors. Once your application is processed, the lender will conduct a thorough review of your application. This may include a assessment and authentication of your records.

- Upon your application is accepted, the lender will issue you a loan contract outlining the details of your 35 loan. Carefully review this agreement before accepting to it, ensuring that you understand all aspects.

- Should you encounter any obstacles during the application process, feel free to consult the lender's customer service team for help. They are there to assist you throughout the journey.

Optimizing Your 35 Loan Payoff Plans

Tackling a sizable loan can feel daunting, but with the right strategies, you can efficiently repay it and gain financial freedom. Here's a blueprint to help you maximize your 35 loan management. First, analyze your current income. Understand your spending habits to determine how much you can realistically contribute towards loan repayment.

- Investigate various repayment options that match your circumstances.

- Focus on making consistent installments to avoid late fees and penalties.

- Boost your repayment ability by reducing expenses.

- Explore a part-time job to expedite your loan resolution.

Keep in mind that patience is key. By staying determined and applying these strategies, you can successfully control your 35 loan and attain your financial aspirations.

Securing a Loan by 35

Taking out a loan in your thirties can be both beneficial and risky. On the one hand, you may have a established credit history and income compared to someone younger, making granting more likely and potentially leading to favorable interest rates. A 35 loan could help you achieve large goals like purchasing a home, starting a business, or consolidating outstanding payments.

However, it's crucial to carefully consider the risks involved. Borrowing money at any age comes with commitments, and missing payments can negatively impact your credit score and lead to financial hardship. It's essential to create a budget that realistically accounts for your monthly loan expenses, ensuring you can comfortably manage the debt alongside other economic obligations.

- Thoroughly research various lenders and compare interest rates, terms, and fees before making a decision.

- Ensure you fully understand the loan agreement and all associated requirements.

- Seek professional financial advice if needed to make an informed selection that aligns with your financial circumstances.

Could a 35 Loan Appropriate for You?

Thinking about taking out a loan of approximately $35? It's an important decision, and it's highly recommended to consider your options meticulously. Before you commit, let's look the pros and disadvantages of a 35 loan. A loan like this could assist you with multiple objectives, but it's also important to comprehend the potential risks.

- Firstly, consider your economic health.

- Moreover, think about your repayment strategy.

- Finally, shop around to obtain the most favorable terms.

Making an informed decision about a loan is essential.

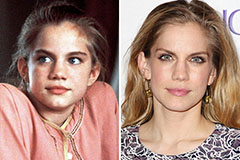

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!